The Complete Guide to Business Funding Options for Advisors

Wiki Article

Navigating the Landscape of Organization Funding: Tips for Successful Working As A Consultant Ventures

Navigating the landscape of business financing presents special challenges for consultancy endeavors. Understanding one's monetary requirements is essential for recognizing appropriate financing sources. Traditional options like bank finances commonly come with rigorous requirements, while different resources such as crowdfunding offer various advantages. The efficiency of a well-crafted organization plan can not be overemphasized. As consultancy business owners discover these avenues, they should additionally consider how to engage possible capitalists effectively. What techniques will verify most effective?Understanding Your Funding Needs

How can a service properly analyze its funding needs? To begin, an extensive examination of the firm's economic wellness is necessary. This consists of assessing capital, existing financial debts, and general earnings. By determining present and future expenses, such as operational prices, advertising and marketing efforts, and prospective expansion plans, a more clear image of funding requirements arises.Next off, services ought to categorize their financing needs into long-term and temporary objectives. Short-term needs might include immediate operational expenditures, while long-lasting financing might support growth or capital expense. Involving with stakeholders, consisting of capitalists and staff members, can likewise provide beneficial understandings into financing demands.

Additionally, conducting marketing research helps organizations comprehend industry criteria and economic problems, further improving their funding evaluations - Business Funding. Ultimately, a detailed understanding of funding needs lays the foundation for seeking ideal financial solutions, making certain business is well-positioned to attain its objectives

Checking Out Traditional Funding Options

After assessing their funding requires, organizations often turn to conventional funding choices to protect the needed funding. These choices commonly consist of financial institution loans, credit lines, and federal government gives. Financial institution financings are preferred for their organized payment plans and relatively low-interest rates, although they might call for substantial paperwork and collateral. Credit lines offer flexibility, allowing organizations to take out funds as needed up to a defined limitation, which can be beneficial for managing cash money circulation. Furthermore, government gives offer non-repayable funds, although they frequently feature stringent eligibility standards and application procedures. Businesses seeking standard funding must prepare extensive business strategies and financial estimates to demonstrate their viability to loan providers. Establishing a strong credit score history is additionally important, as it substantially affects the chance of approval and the terms supplied. Ultimately, recognizing these conventional methods enables services to make enlightened decisions concerning their financing techniques.

Leveraging Choice Funding Resources

As businesses seek ingenious ways to secure financing, alternate resources have acquired importance. Crowdfunding systems and gives from competitions use one-of-a-kind opportunities for entrepreneurs to increase resources without traditional financial obligation. Discovering these alternatives can provide not only financial backing yet additionally valuable exposure and community interaction.Crowdfunding Platforms Checked Out

What cutting-edge remedies can business owners locate in the domain of crowdfunding? Crowdfunding systems offer a special opportunity for funding, allowing start-ups to provide their concepts straight to prospective backers. By leveraging systems like Kickstarter, Indiegogo, and GoFundMe, entrepreneurs can engage a neighborhood of advocates who have an interest in their vision. These platforms not only provide funding but also valuable market validation and direct exposure. Business owners can customize their campaigns to highlight their distinct selling points, using engaging visuals and narration to draw in interest. Additionally, crowdfunding cultivates a feeling of ownership among backers, frequently leading to loyal consumer bases. Generally, crowdfunding presents a accessible and adaptable financing choice, enabling business owners to understand their consultancy endeavors while lessening financial threat.Grants and Competitions

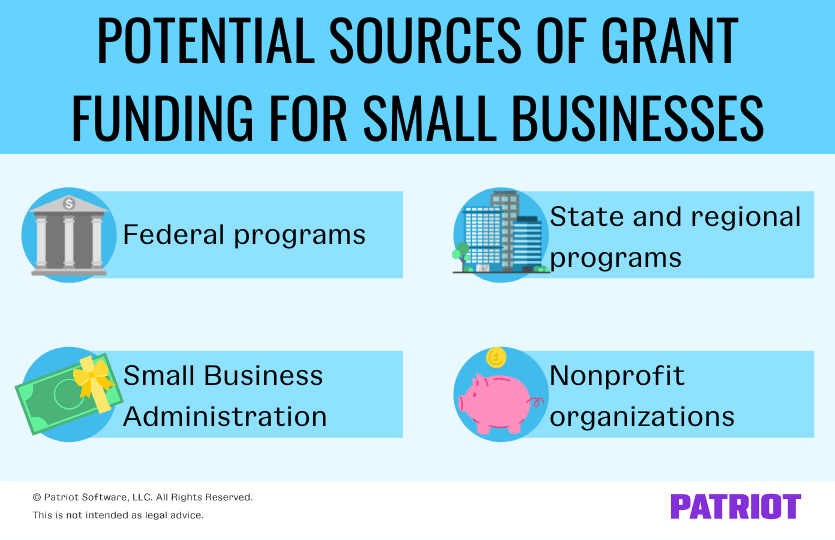

While several entrepreneurs focus on typical funding approaches, tapping right into grants and competitions can access alternative resources of funding that usually go forgotten. Grants are normally awarded by government firms, structures, or agencies, and can supply considerable economic support without the obligation to pay back. Competitors, on the other hand, commonly require entrepreneurs to present their service ideas for a possibility to win prize money or financial investment. These chances not only provide financing yet additionally enhance visibility and reputation within the sector. Entrepreneurs must actively seek out appropriate gives and competitors, guaranteeing they fulfill eligibility criteria and straighten their applications with the funding bodies' objectives. By diversifying financing approaches, consultancy endeavors can bolster their financial stability and development capacity.

The Function of Organization Plans in Protecting Financing

An extensive business strategy functions as a vital tool for entrepreneurs looking for funding, given that it outlines the vision, strategy, and financial forecasts needed to attract potential capitalists. It supplies an organized strategy that demonstrates the expediency of the business concept, detailing market evaluation, affordable landscape, and operational plans. Capitalists typically seek guarantee that their funds will certainly be utilized properly, and a well-crafted company strategy addresses this by illustrating predicted revenue streams and expenditure management.Furthermore, the service strategy offers as a roadmap for the entrepreneur, assisting decision-making and helping to identify prospective obstacles. Quality and precision in the strategy can considerably enhance trustworthiness. Financial forecasts, including money circulation declarations and break-even analysis, are crucial components that aid prospective capitalists analyze danger. Generally, a compelling service strategy not only helps secure funding however also prepares for the effective implementation of business vision.

Networking and Structure Relationships With Investors

Establishing a strong network and growing relationships with investors are vital steps for entrepreneurs seeking funding. Structure these links calls for a critical strategy, as capitalists usually favor to collaborate with people they understand and count on. Taking part in industry occasions, seminars, and networking functions allows business owners to fulfill prospective financiers, share their vision, and create long-term impacts.Preserving consistent Extra resources interaction is important. Entrepreneurs need to keep investors educated regarding their progress, turning points, and obstacles, promoting transparency and depend on. Customizing communications by comprehending investors' passions and preferences can additionally enhance relationship-building initiatives.

Utilizing social media sites platforms, specifically LinkedIn, can further widen an entrepreneur's outreach, allowing links with a diverse series of investors. By proactively participating in discussions and sharing pertinent content, entrepreneurs can place themselves as well-informed market gamers, increasing their possibilities of safeguarding funding. Business Funding. In this competitive landscape, solid partnerships with investors can be a crucial differentiator for success

Planning For Pitch Meetings

Next off, consultants ought to create a clear, concise pitch that highlights their distinct worth proposition and describes business model. Visual help, such as slides or models, can enhance understanding and interaction. Exercising the pitch is crucial; rehearsing in front of peers can assist improve and identify potential weaknesses shipment.

Expecting concerns and preparing thoughtful actions is important for attending to financier worries successfully. Eventually, showcasing enthusiasm and confidence, while being open to feedback, can leave a lasting impression and foster an effective discussion throughout the pitch meeting

Managing and Utilizing Funds Properly

Reliable administration and usage of funds are vital for company success. Strategies for budget appropriation and cautious monitoring of capital can considerably impact total monetary health. By implementing these techniques, companies can guarantee that their sources are used successfully to sustain growth and sustainability.Spending Plan Allotment Strategies

Keeping Track Of Capital

Monitoring capital is essential for businesses aiming to preserve monetary security and development. Reliable capital management involves tracking outbound and incoming More Info funds to ensure that costs do not go beyond earnings. By routinely evaluating capital statements, services can determine patterns and prospective deficiencies, allowing proactive decision-making. Additionally, maintaining a cash get can give a barrier for unforeseen expenses and changes in income. Companies need to additionally focus on timely invoicing and adopt approaches to quicken collections, lessening delays in cash inflow. Making use of economic administration software can streamline checking processes, offering real-time understandings right into cash placement. Eventually, persistent cash money circulation monitoring is crucial for maintaining operations and promoting calculated investments in the working as a consultant landscape.Often Asked Inquiries

why not try these outWhat Are Typical Mistakes to Stay Clear Of When Seeking Financing?

Common blunders when seeking financing include insufficient research on possible investors, vague company strategies, ignoring economic requirements, disregarding to develop partnerships, and failing to successfully communicate value suggestions, which can hinder successful financing acquisition.The length of time Does the Funding Process Commonly Take?

The funding process normally takes anywhere from a couple of weeks to several months, depending upon variables like the funding type, the intricacy of the proposition, and the responsiveness of both events associated with the settlement.What Are the Tax Obligation Effects of Different Financing Sources?

Tax implications vary by moneying resource; gives might be tax-free, loans require rate of interest reductions, and equity financial investments can bring about resources gains tax obligations. Consulting a tax obligation professional guarantees conformity and ideal financial planning for businesses.Can I Secure Funding With a Poor Credit Rating History?

Yes, securing funding with a poor credit rating is difficult, but possible. Different lending institutions and crowdfunding systems might think about other elements, such as business plans and capital, as opposed to entirely relying upon credit report.:max_bytes(150000):strip_icc()/how-to-apply-for-a-small-business-grant-7644287-final-fa2a2db9751346408b49a50c5fe8a9d8.png)

Just how Often Should I Update My Company Plan After Getting Funding?

A service strategy must be upgraded consistently, preferably every 6 months, to mirror adjustments in market problems, organization objectives, and economic efficiency. This assures recurring placement with financing demands and calculated goals.Exactly how can a company efficiently evaluate its funding requires? Next off, services must classify their funding needs right into long-lasting and short-term objectives. After reviewing their financing needs, businesses often transform to standard funding options to safeguard the needed funding. Businesses seeking standard funding should prepare detailed service plans and monetary estimates to demonstrate their stability to lending institutions. A comprehensive company strategy serves as an important device for entrepreneurs looking for funding, given that it details the vision, strategy, and monetary projections needed to attract potential financiers.

Report this wiki page